- UID

- 47048

- 热情

- 7304

- 人气

- 8269

- 主题

- 59

- 帖子

- 1523

- 精华

- 0

- 积分

- 8610

- 分享

- 0

- 记录

- 0

- 相册

- 1

- 好友

- 0

- 日志

- 0

- 在线时间

- 3250 小时

- 注册时间

- 2005-8-19

- 阅读权限

- 30

- 最后登录

- 2025-9-18

升级    72.2% 72.2% - UID

- 47048

- 热情

- 7304

- 人气

- 8269

- 主题

- 59

- 帖子

- 1523

- 精华

- 0

- 积分

- 8610

- 阅读权限

- 30

- 注册时间

- 2005-8-19

|

The number of mortgagee sales has jumped nationwide in the past quarter as worsening economic conditions and lower dairy payouts hit parts of provincial New Zealand.

But as the nation's "rock star" economy comes off the boil, experts are warning of more foreclosures outside Auckland's surging property market as financially strapped homeowners in regional New Zealand start defaulting on their mortgages.

"People lose interest in their properties, they lose interest in their lives and the bank senses that, and that's when you have distressed sales," Harcourts agent and mortgagee specialist David Savery said.

Nearly 150 people lost their homes in distressed sales in the three months to June 30, compared with just 95 in the first quarter - a jump of more than 50 per cent - CoreLogic figures provided exclusively to the Herald show.

In the year to June nearly 700 Kiwi homeowners lost their properties - 84 of them in Auckland. Though the annual figures were down on previous years, foreclosure numbers appear to be plateauing again after a period of sustained falls.

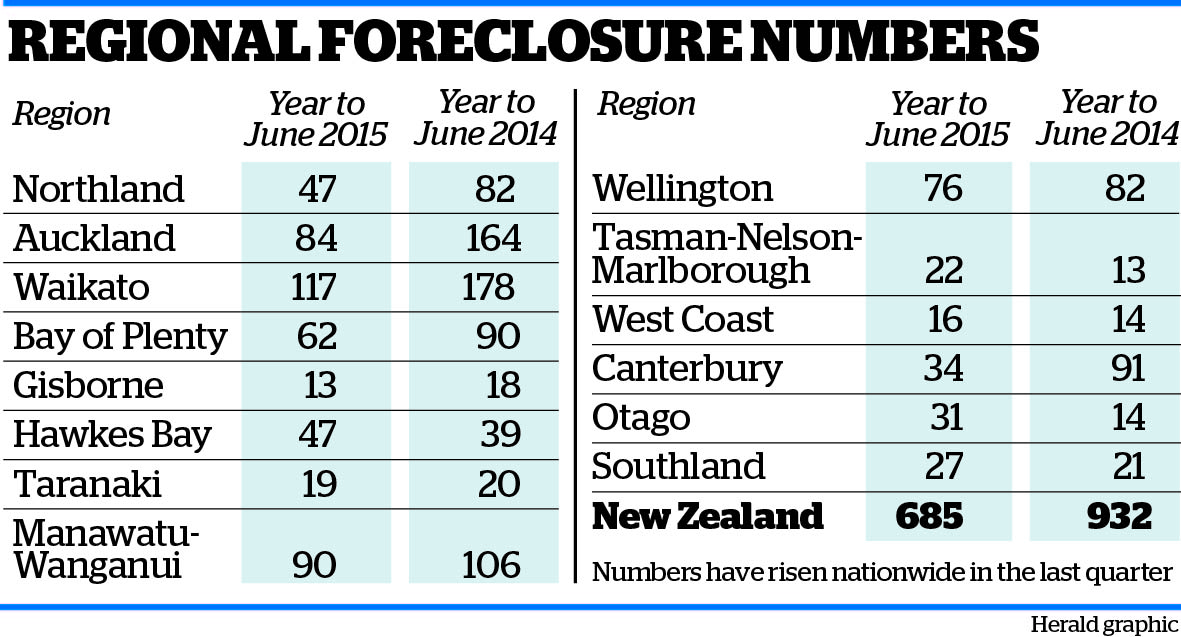

Five of the nation's 14 regions recorded a jump in forced sales in the past 12 months: Hawkes Bay (47), Otago (31), Southland (27), Tasman-Nelson-Marlborough (22) and West Coast (16).

Waikato had the most (117), followed by Manawatu-Wanganui (90), Auckland (84) and Wellington (76).

Mr Savery expected the number of distressed sales to increase in farming-reliant economic regions as conditions tightened.

He cited lower payouts to dairy farmers, who have just had their forecast payout slashed by Fonterra to $3.85 per kilo of milk solids, sucking $3.3 billion from suppliers and leaving the average dairy farmer facing a $250,000 loss this season.

Higher fuel prices, limited wage growth and muted provincial property markets were also factors.

"What's been keeping people alive is equity in their properties. But in any other centre [outside Auckland], it's going to be difficult for people to keep their equity in their property because there's been no real growth."

Farmers and related businesses would be worst hit from the falling returns, Mr Savery said.

"There's not a lot of margin so if the payout is reduced and sales come back ... we're going to see more and more mortgagee sales."

Economist Shamubeel Eaqub agreed more provincial foreclosures were likely but he did not expect a dramatic increase.

Mortgagee sales were seasonal and tended to lag any downturn so a jump in numbers would not become evident until next year, he said. Mortgagee sales were seasonal and tended to lag any downturn so a jump in numbers would not become evident until next year, he said.

"If we think of the provinces, in many of those places they're ageing populations. It's not young people who have had recent mortgages, so it's going to be a fairly small percentage ... exposed to the risks.

"What we instead tend to see is lots of people really knuckling down and making do with what they've got and that sort of perpetuates the slowdown in the economy because people aren't out there spending, they're trying to pay off their mortgages."

Federated Farmers president William Rolleston said sucking billions of dollars from regional economies would put rural areas under stress. "Yes, I would expect the number [of foreclosures] to increase but I'm not predicting a wholesale crisis to appear ...

"I think banks have been pretty responsible in this situation and are looking to support their farmers."

Mortgagee sales

•149 nationwide from April to June - a jump of 56 on previous quarter.

•However, 685 in year to June 30 - a 36 per cent drop on previous 12 months.

•84 Auckland properties defaulted in the past 12 months compared with 164 in the previous year.

- NZ Herald

|

|